How to Choose the Best Business Entity for Your New Business

Whether you’re an experienced entrepreneur or someone who is just making the leap from 9-5 job to business owner, deciding which type of business structure to create is a big decision, with a lot at stake. Taxes, flexibility, liability, and more can be affected by your choice of legal entity.

Here, we’re covering the difference between each business entity type so you can make a more informed decision about what’s best for your new company.

Business Entity Types

Find each of the entities listed below with who it’s best for and what it entails.

Sole Proprietorship

Sole proprietorship is the simplest business structure that you can choose for your business. Not only it is easy to set up but also easy to manage and dissolve. One person owns the entire business and thus there is no division in management or ownership.

It is ideal for small businesses such as consultants, freelancers, mobile food vendors, and similar businesses. This is because sole proprietorships are taxed as personal income, so they do not pay taxes separately from the business owner. Many freelancers and small business owners choose to form sole proprietorships because it allows for easy tax filing and because it can help them get started investing in their business with little capital.

Sole proprietorships are also great for hiring family members, like your own children, giving them valuable business experience and tax savings. The only downside to being a sole proprietor is that it cannot transition into other entity types very well. This only affects owners when benefits begin to look more attractive in other entity types.

Limited Liability Companies (LLCs)

A limited liability company, or LLC, is a business structure that provides the benefits of a corporation and the flexibility of a partnership. A limited liability company can be a beneficial option when starting a business for many reasons. The biggest benefit is the protection from personal liability. If a member of the LLC is involved in a lawsuit, they will not be responsible for any costs associated with the lawsuit if it arises from actions taken within the scope of the LLC.

Like a corporation, the LLC separates its owners’ personal assets from the company’s assets, but like a partnership, an LLC offers pass-through taxation. An LLC is often recommended for businesses that plan to be in business for the long term. Single-member LLCs are the most common LLC business entity type with just one owner.

Partnerships

Partnerships are the simplest business structure to set up, but they aren’t for everyone. They can be especially risky when there is no formal agreement between partners.

A general partnership is an unincorporated business owned by two or more people who share in the profits and losses of the business. A general partnership can be difficult to dissolve. Each partner has unlimited liability for all obligations of the partnership and may be held personally responsible for all debts, contracts, and actions of other partners.

A limited partnership (LP) has both general and limited partners. The general partner handles day-to-day operations while the limited partner provides money or property to fund the business venture, but has no responsibility for management or liability beyond providing capital to the business.

A limited liability partnership (LLP) has members who act as managers, employees, and/or owners depending on how their ownership interest is structured. An LLP protects each owner from personal financial liability if the business incurs debt or encounters legal problems that exceed its assets.

Partnerships are most often entered into when someone wants to start a small business with friends or family members, or wants to test business ideas before fully committing.

Corporations

A corporation is a more complex structure that separates the owner from the business itself. The goal is to minimize taxes, but it also offers limited liability protection for the owner and his or her personal assets. This means that if the corporation runs into legal trouble because of something the owner did, creditors can’t go after anything other than corporate assets.

There are 3 corporation types: C, S, and B.

A C corporation is the most versatile business structure because it can offer the limited liability protection of a corporation as well as the ability to distribute earnings as dividends to shareholders. The IRS describes a C corporation as “a taxable entity that has elected to be treated as a separate taxable entity from its owners.” In other words, it’s a legal stand-in for the company itself.

An S corporation is a legal business structure that is taxed as a partnership or sole proprietorship but can enjoy limited liability like a corporation. It has become very popular because it allows the owners to avoid double taxation (once at the corporate level and again at the individual level).

A B corporation is a for-profit company certified by the nonprofit B Lab to meet rigorous standards of social and environmental performance, accountability, and transparency.

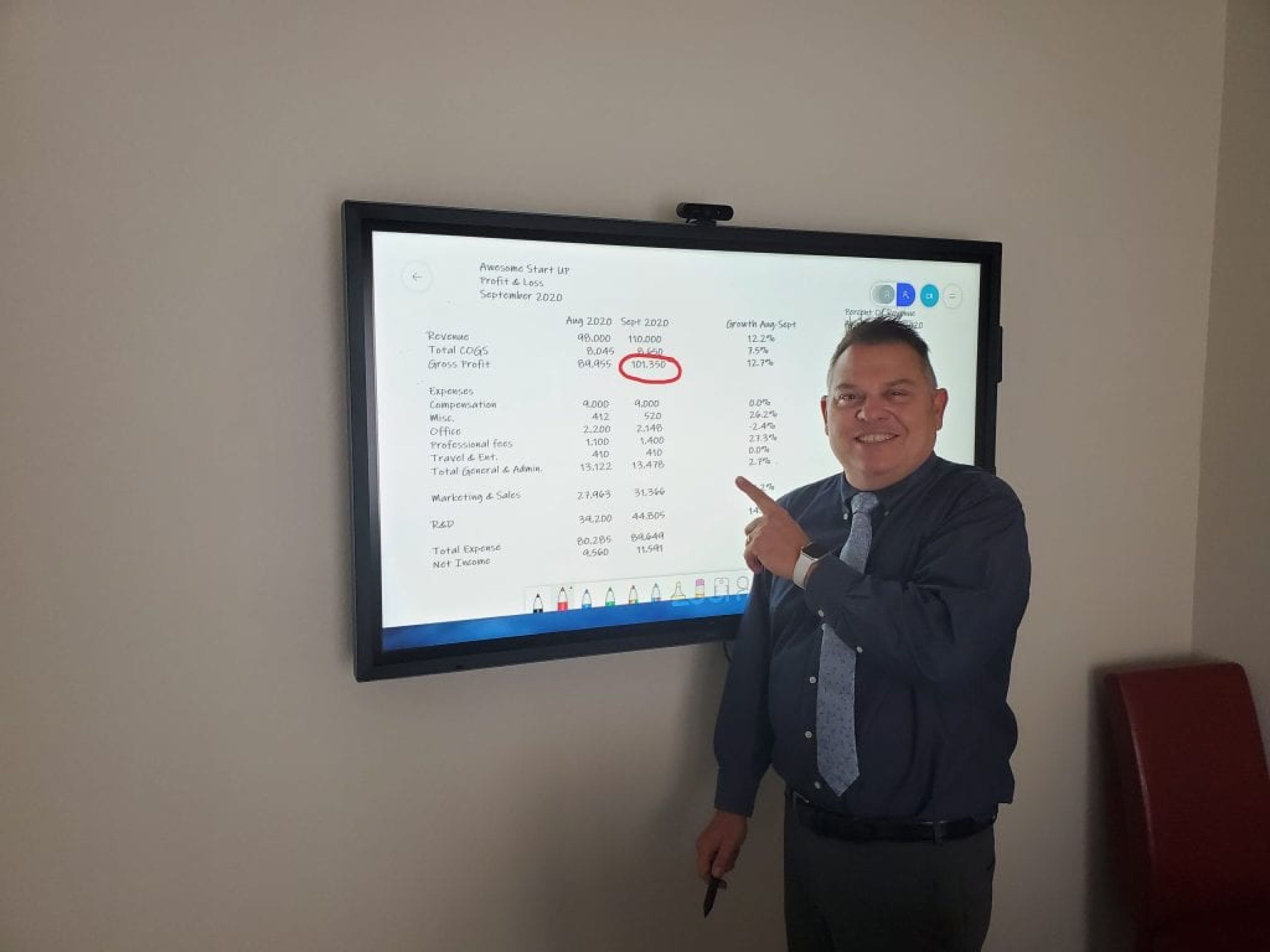

Need Help Deciding Which Business Entity is Right for You?

Speak with us about your new business and we’ll help you choose which entity is best as well as prepare for incorporation.