Maximize Your Business Vehicle Deductions by Doing This

If you use a vehicle in your business, there are three common deduction options you can choose to maximize your deduction. The three options are: business use of vehicle up to the standard mileage rate, actual expenses (mileage and expenses), and the cents-per-mile method for business use of your vehicle.

Business vehicles are different from your everyday personal vehicles, but they’re used by many to get to work or run errands. The biggest difference? You can write off certain vehicle expenses on your taxes. Vehicles are considered business vehicles if your business is required to operate them for income-producing activity. If you are using a vehicle for income-producing activity, the IRS has strict requirements for what type of vehicle you are allowed to deduct expenses on.

What Are Your Vehicle Deduction Options?

The deduction rules for business cars, trucks, and vans are complicated, but they offer significant savings if you qualify. Here’s what you need to know:

Business-related mileage deduction. If you use your car more than half the time for business, the IRS allows you to deduct mileage based on actual expenses or based on the standard mileage rate, which is 56 cents per mile for 2016. You can also use the actual expense method without claiming the standard mileage rate in certain circumstances.

The percentage of business travel represented by your total mileage will determine whether it’s better to use actual expenses or the standard mileage rate. For example, if you drive 20 percent of your miles in a given year for business, it may be better to use actual expenses because they will be less than 56 cents per mile.

Deduction limits. The total amount of deductions allowed in one year for car costs is limited by IRS rules. Generally speaking, when you’re figuring how much of a deduction you’re allowed for an automobile, you can deduct your actual vehicle expenses.

Here’s a tip: use mileage tracking tools on all of your vehicles to keep better track of what’s deductible. Even for certain personal use applications, these tools can be used to help find savings. Like if employees use their personal vehicles to run errands for work, these tools can help them deduct those expenses on their W2s.

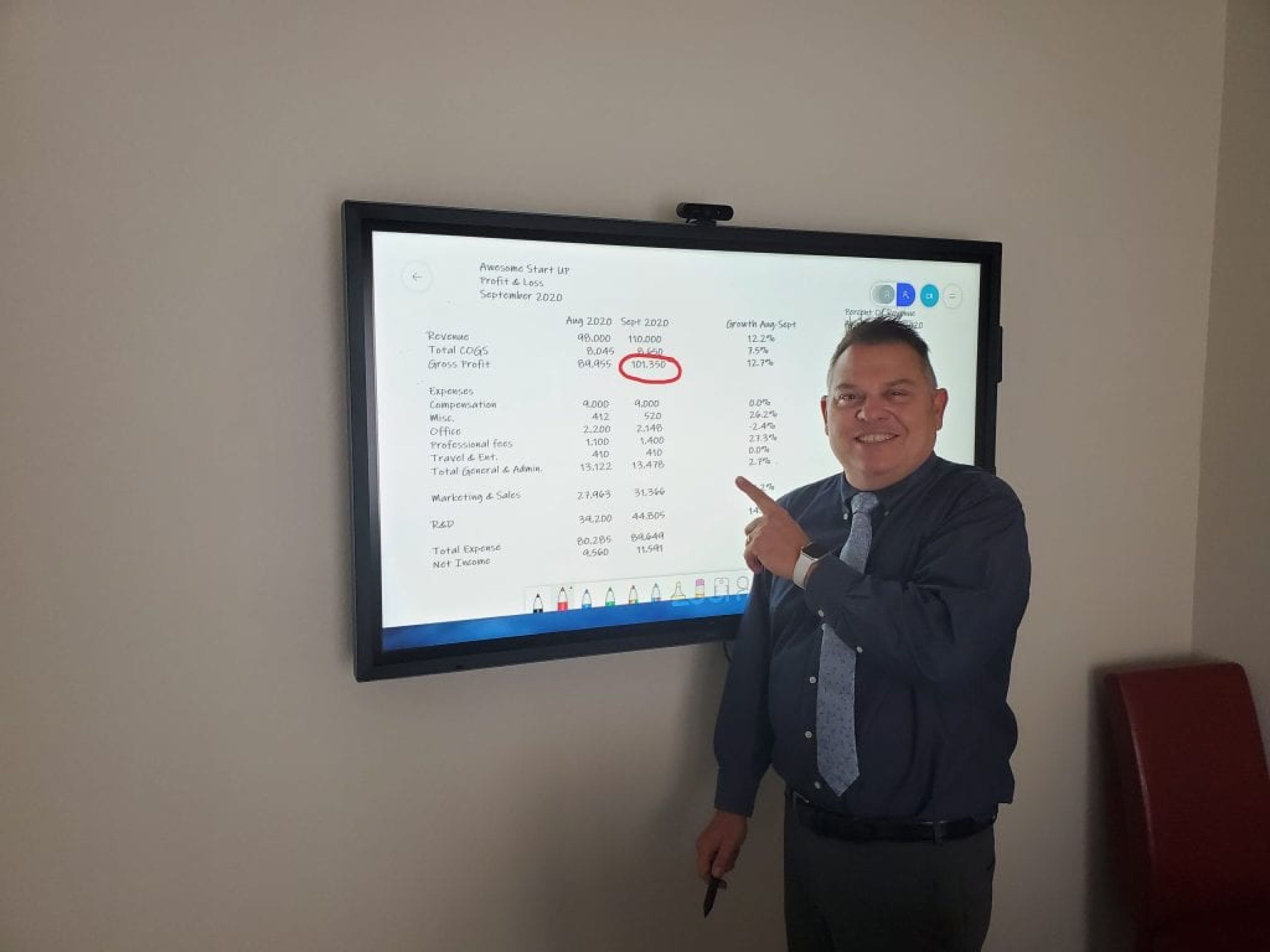

What Happens When The Business Owns More Than 5 Vehicles?

If you have more than five vehicles, it’s important to understand the tax rules so you can claim the right deductions.

If you own a fleet of vehicles for your business, you have more choices in how you deduct the costs of operating them. Here are some factors to consider:

Vehicle type. The most common deduction is for operating vehicles that are used 100 percent for business. If you own a vehicle that is used less than 100 percent for business, claiming it as a deduction becomes more difficult. You can still deduct its business use, but there are limitations on how much of the value of the vehicle can be deducted (see below).

You must also keep accurate records of which vehicle was used for what purposes during the tax year, including the percentage of time each vehicle was used for personal versus business use.

How to calculate depreciation. If you’re claiming depreciation on any vehicles that are not 100- percent business use, then your calculation needs to be fairly complex (and fairly accurate) since depreciation is required by law. That’s because depreciation is based on time instead of use.

What About Providing Company Cars to Employees?

Businesses that provide company cars to their employees can deduct the costs associated with acquiring, operating, and maintaining them.

Additionally, you can claim the actual expense of using the car for business purposes which allows you to deduct gas, insurance, repairs, license, registration fees, and depreciation.

If you lease the car it’s likely that you’ll use MACRS (modified accelerated cost recovery system). This allows you to write off a portion of the purchase price each year over a period of five years. If you buy a car with a longer lifespan than five years, then your write-off is spread out over a longer period of time.

In most cases when determining how much you can deduct for everyday business use you will need to keep track of mileage. You can do this by recording odometer readings at the beginning and end of each year. Then add up all your mileage from business trips for that year and divide it by total mileage for the entire year. The resulting percentage is how much you can deduct from your taxes.

By keeping these considerations in mind when filing taxes, you can easily maximize your business vehicle deductions and increase resources for your business. Contact us about your vehicle’s deductions and find out how much you can save now.