Here’s What You Need to Know About Reporting Crypto on Your Taxes

Cryptocurrencies have become an interesting topic of discussion lately and with the continual rise in their value, it’s easy to understand why.

If you’ve dabbled into bitcoin trading or you’re curious about how crypto works come tax season, then you’ve come to the right place. We’ll cover four of the most important questions you need answered to understand crypto this coming year

What Are Cryptocurrencies?

Cryptocurrencies are a subset of digital currencies that are decentralized and utilize cryptography to secure transactions and to control the creation of additional units of the currency. The most popular cryptocurrency right now is bitcoin.

Cryptocurrencies make it easier to transfer funds between two parties in a transaction; these transfers are facilitated through the use of public and private keys for security purposes. These fund transfers are done with minimal processing fees, allowing users to avoid the steep fees charged by most banks and financial institutions for wire transfers.

They are also known as virtual currencies or digital currencies.

Do I Have To Report Crypto On My Taxes?

Cryptocurrencies are property, not currency, so those transactions are taxable. However, the IRS currently requires you to calculate your capital gains and losses as if they were foreign currency transactions.

Treat crypto like a stock. For tax purposes, the I.R.S. treats Bitcoin and other virtual currencies as property, not currency. This means that if you buy something with a cryptocurrency, or trade one cryptocurrency for another, any resulting gains or losses could be taxable income or capital gain.

You do not have to report each and every transaction (like a retail purchase) in which you used cryptocurrency. Instead, if it was a personal use (not business-related), the calculation is based on the cost basis for the cryptocurrency (when you bought it). This will be adjusted by the fair market value of each coin when you sold it. So no, you don’t need to report all your transactions, but it would be good practice to save documentation of any transaction that was “real” money. The IRS has previously stated that Bitcoin is “intangible property.”

When Do I Need To Report The Crypto I Bought/Sold On My Taxes?

The IRS is still trying to figure out how to deal with cryptocurrencies. For now, it seems the best way to prepare for tax season is to keep track of your crypto transactions and include them in your annual income tax report.

If you didn’t cash out your virtual coins, then the IRS treats them as property rather than currency, so any increase in value is considered a capital gain and must be reported as such.[1] For example, if you bought 1 Bitcoin for $100 and later sold it for $300, you’d have to add $200 of income to your tax return (the amount of money you made from selling the coin). If you bought multiple coins at various prices throughout the year and sold some of them by the end of the year, you’ll have to tally up all of your gains/losses and report them on one line.

To calculate your crypto capital gain or loss, you can use a crypto-currency calculator online. However, the safer and more accurate way to report them is through a professional service like ours.

What Should I Keep Track of In Terms of My Crypto Currencies?

Given the nature of cryptocurrencies, it is impossible to predict what tax obligations may be imposed on investors or how those obligations will be enforced. It is also unclear if cryptocurrencies will not become subject to regulations that are similar to those imposed on securities. However, there are certain steps that an investor can take to ensure that he or she doesn’t run afoul of the IRS.

Keep good records. If you purchase a cryptocurrency at an exchange, you likely will receive a Form 1099 from the exchange reporting your purchase and the amount you paid (in U.S. dollars). You should keep this form in a safe place along with your other tax documents. Similarly, if you receive any type of virtual currency as payment for goods or services, whether as a business or an individual, you should keep track of the fair market value in U.S. dollars at the time of receipt. This information can come in handy if you need proof of payment to support deductions or credits and when filing your return.

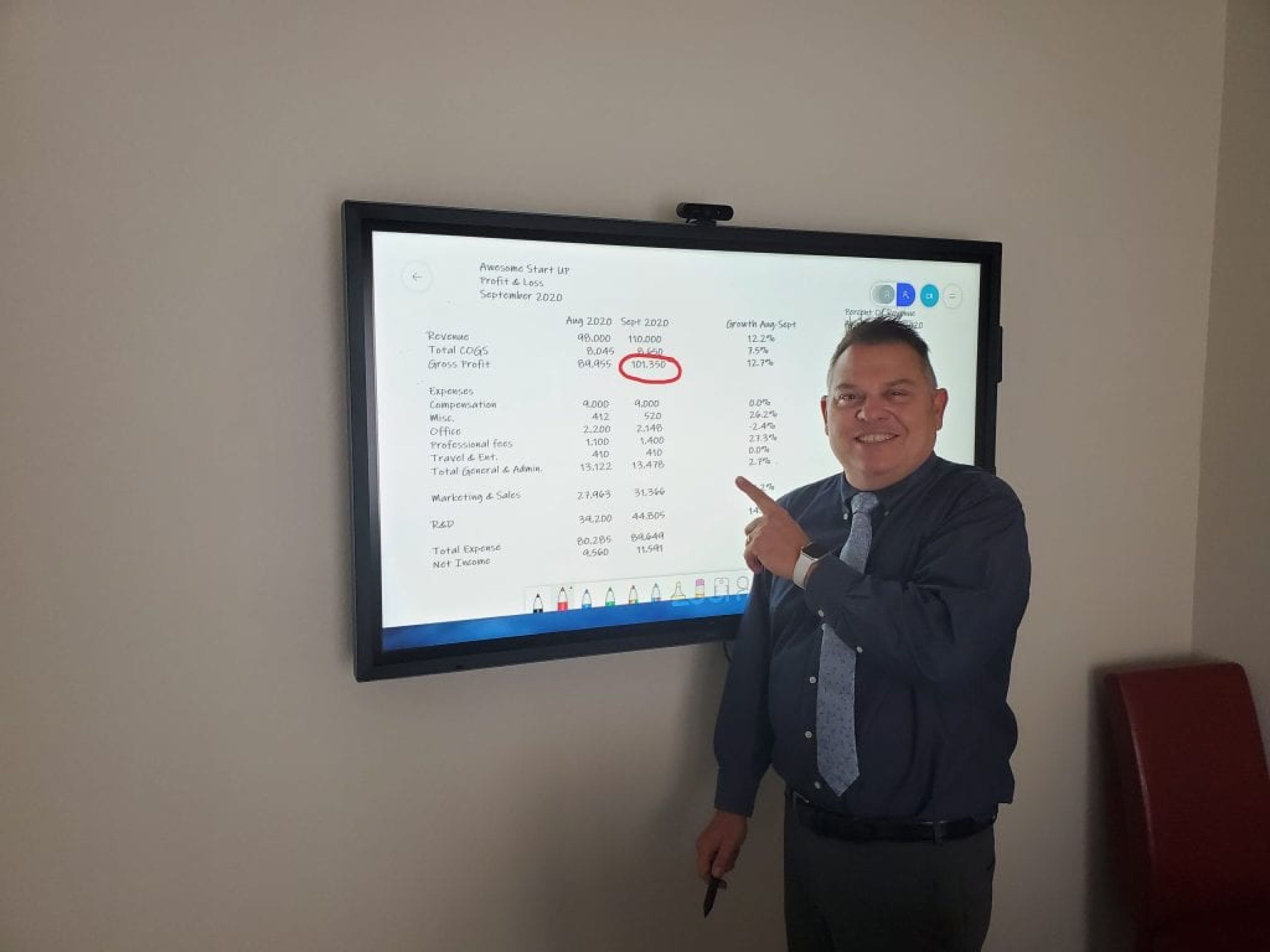

Consult with an accountant or tax attorney. John Warekois CPA, LLC is knowledgeable about cryptocurrencies and their tax implications. We can help you make sure that you correctly report any transactions involving cryptocurrency on your income taxes as well as better prep for the following year. Get in touch with us today to get sorted for the upcoming tax season.