All You Need to Know About Capital and Your Small Business(SMB)

Starting a business requires initial capital for inventory, renting office space, and other startup costs. There are different approaches to financing a business: personal savings, taking on debt (from a bank or the SBA), or receiving investment capital from outside sources.

Planning for capital will vary depending on the business structure you choose, but what does not change is that you will need to have capital to keep your business running. Banks, CPAs, and Small Business Administration (SBA) loan officers are familiar with what it takes to start a small business and would be excellent resources to help you get started.

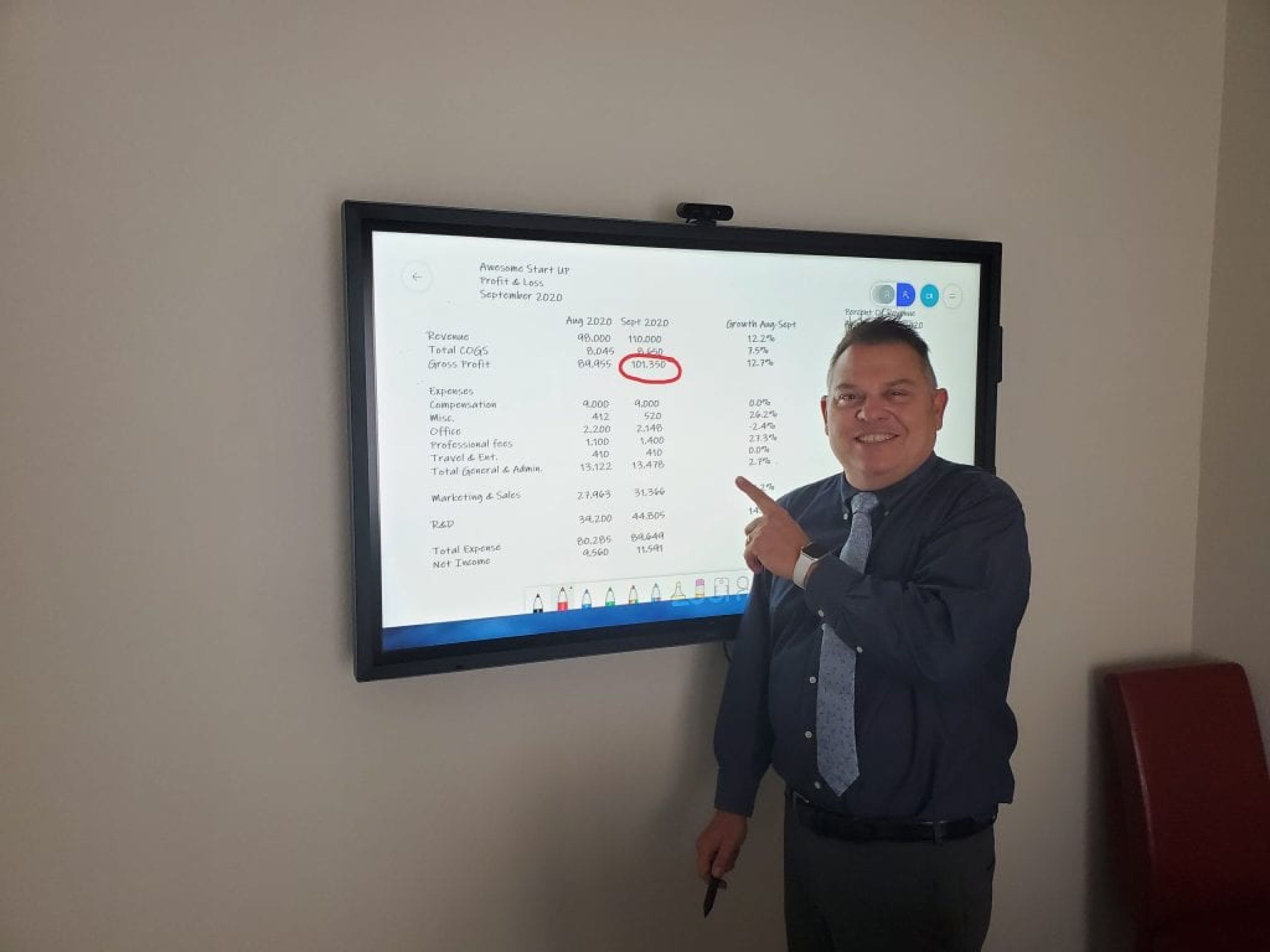

How Much Capital Do I Need To Start My Business?

This is a question many small business owners are pondering as they prepare to open their doors for business. The answer, however, depends on the type of business you’re planning to open and the amount of risk involved in operating your business.

There are typically three categories that influence startup costs: tangible assets, intangible assets, and working capital. Tangible assets include all physical property involved in the operation of the business such as buildings and equipment. Intangible assets are resources such as patents, trademarks, goodwill, and customer relationships that do not have a physical form but that have value to the business such as intellectual property rights or brand awareness. Working capital represents cash needed to start operating until revenues exceed expenses.

In general, you will need to have enough working capital to cover your start-up costs, operating expenses, and other costs that may come up during the first year of operation.

To determine how much working capital you will need to start your business, you should first make an estimate of your start-up costs. These include the following:

- Cash that is needed to purchase equipment and pay contractors or employees who do not work exclusively for cash.

- Investment in inventory or raw materials required by your business. For instance, if you have a retail store that sells clothing, you will need to purchase inventory before you can open for business.

- The initial investment in office furniture, fixtures, and equipment (FFE).

- Inventory of supplies or raw materials used in the production or delivery of goods and services.

Use the SBA’s business plan worksheets as a helpful tool to get started.

Is Going Into Debt With A Business Loan A Good Idea?

It’s never a good idea to go into debt for your business or to take out a loan as a first resort. However, there are situations where you might be able to get a small business loan from the bank that makes financial sense.

Finance experts say entrepreneurs should be careful about taking on debt when starting or growing their businesses. Business loans take away some of the financial risks for small businesses, but at the same time, they can increase it by adding more money-related stress to an entrepreneur who doesn’t have enough working capital.

A good rule of thumb is to have enough money saved up to cover three to six months’ worth of business expenses in case your company hits hard times and loses money quickly. If you don’t have enough capital, going into debt with a business loan from a bank or the SBA (Small Business Administration) could be risky but not necessarily a bad move, depending on your individual situation.

If you run into trouble repaying your debts — if your business fails and it’s not covered by insurance — then your assets could be at risk. However, if your business does well, then the assets of your company can pay off your debts.

Only take out a loan if it’s essential to starting and running your business. If you do decide to take on debt, make sure that you have a detailed plan for repaying it and that you get professional advice before entering into any agreements.

What Are The Benefits of Accepting A SMB Loan?

Stability

Taking out a loan can help your business become more stable. After all, the loan gives you access to more cash than what you already have on hand, which means that you’ll be able to hire employees or purchase supplies without worrying about how you’ll pay for these things in the future.

Flexibility

Many small businesses struggle with cash flow issues because they don’t have enough money on-hand to meet expenses when they’re due. A loan can help solve this problem because it gives an entrepreneur access to cash when they need it.

Leverage

One of the biggest advantages to getting a loan is that it gives entrepreneurs leverage. If they want to expand their business but don’t have any cash flow, a loan can help them get started by allowing them to borrow money while they wait for revenue.

What Are The Risks of Accepting A Business Loan?

Actual Costs

Borrowing costs vary by lender, but the important thing to remember is that the cost of the loan can be more than just the interest rate. When you borrow money, you will also have to pay for things like application fees, origination fees, and appraisals. These extra costs can add up quickly.

Length of Repayment

Most small business loans are set up on an amortized schedule, which means that your monthly payments will be lower at first but then increase over time. If your small business has trouble making higher payments in the future, you could end up facing foreclosure or bankruptcy.

Debt Impact

Loan obligations can impact your personal credit rating and your ability to get other loans in the future. Your lenders will report how much you owe and your payment history on your credit reports. Multiple missed payments can result in a serious credit score drop which could make it very difficult for you to get a loan of any kind in the future.

For more assistance on getting your SMB ready, contact John Warekois CPA, LLC.