The Top Reasons Businesses Fail – Are You at Risk?

Did you know that over half of businesses fail within the first two years (Upwork) and 65% won’t last longer than six years due to lack of planning, inadequate financing, bad marketing, and ineffective management?

These top 4 reasons why businesses fail are enough to scare anyone away from starting a business. But all businesses face exigencies and dangers, so let’s look a closer look at each so you can get a better picture of how to avoid them.

Poor Planning Leads to Business Failure

You could have the greatest idea the world has ever seen and still fail all because of poor planning. According to the Small Business Administration, most small businesses fail because of poor management, with insufficient cash flow being a close second. Poor planning often leads to poor management, which in turn leads to business failure.

If you are running a business with limited resources, you need to plan with limited resources.

The more your plan reflects the reality of your limited resources, the better your business will do. If you start out with a plan that is too big for your budget or too big for what people are willing to pay for your product, you are doomed to failure before you begin.

Inadequate Financing Is a Business Killer

When a business is struggling, it’s often because of inadequate financing. Business owners can’t always anticipate their needs for cash flow and may have to scramble to find the resources they need to keep their business running. Here are some of the reasons businesses fail due to inadequate financing:

Unrealistic growth projections. If a business owner has overly optimistic expectations about the revenue their company will generate, they may find themselves unable to pay their bills when things don’t go as planned. Unrealistic start-up costs. When a new business owner is starting up, they may be unaware of the true costs involved in running the business. Businesses which must be started up with minimal startup capital may never get off the ground if those funds run out before the company begins turning a profit.

Failure to plan for cash flow needs. Business owners should carefully track their expenses and revenue and look for warning signs that there might not be enough money coming in to cover necessary payments like payroll and rent.

Poor cash management. Business owners should keep at least several months’ worth of operating expenses on hand as a reserve fund in case unforeseen cash flow problems arise.

Small businesses which operate on lean margins should consider keeping even more than that on hand as a cushion against unexpected expenses or slower than expected cash flow.

Bad Marketing Can Destroy a Business

Bad marketing can help push a business to failure. The most obvious reason is that there’s no demand for the product or service. You can’t sell a product or service if no one wants it. But poor marketing is also a contributing factor in businesses that fail because of faulty products,bad business decisions, management issues, or other factors.

Some of the more common mistakes for new businesses is marketing based on their expectations, not from market research. If you promote a product to the wrong demographic,then you simply won’t see interest. The same can be said for marketing to the right demographic but with the wrong message.

A higher marketing budget is helpful, but a big budget doesn’t equal success. Businesses need to work with the funds they have and perform extensive market research in order to create a successful marketing scheme. When budgets are low, social media marketing is one of the best ways to gain traction.

Ineffective Management Leads to a Business’ Downfall

Not all businesses fail because of bad luck. Some go under because of bad decisions made by those in charge. If you don’t know what’s going on with your business, how can you expect it to succeed?

This is why it’s important to understand the character traits of an effective leader before you accept a leadership role in your business. Good leaders must be adaptable and willing to change course if necessary. They must be able to inspire confidence in others and move the business forward by motivating employees to do their best work. Effective leaders create an environment where employees feel valued and do not fear change or growth opportunities. Good leaders also know how to motivate employees to be accountable for their work and results, which prevents unethical behavior within the workplace.

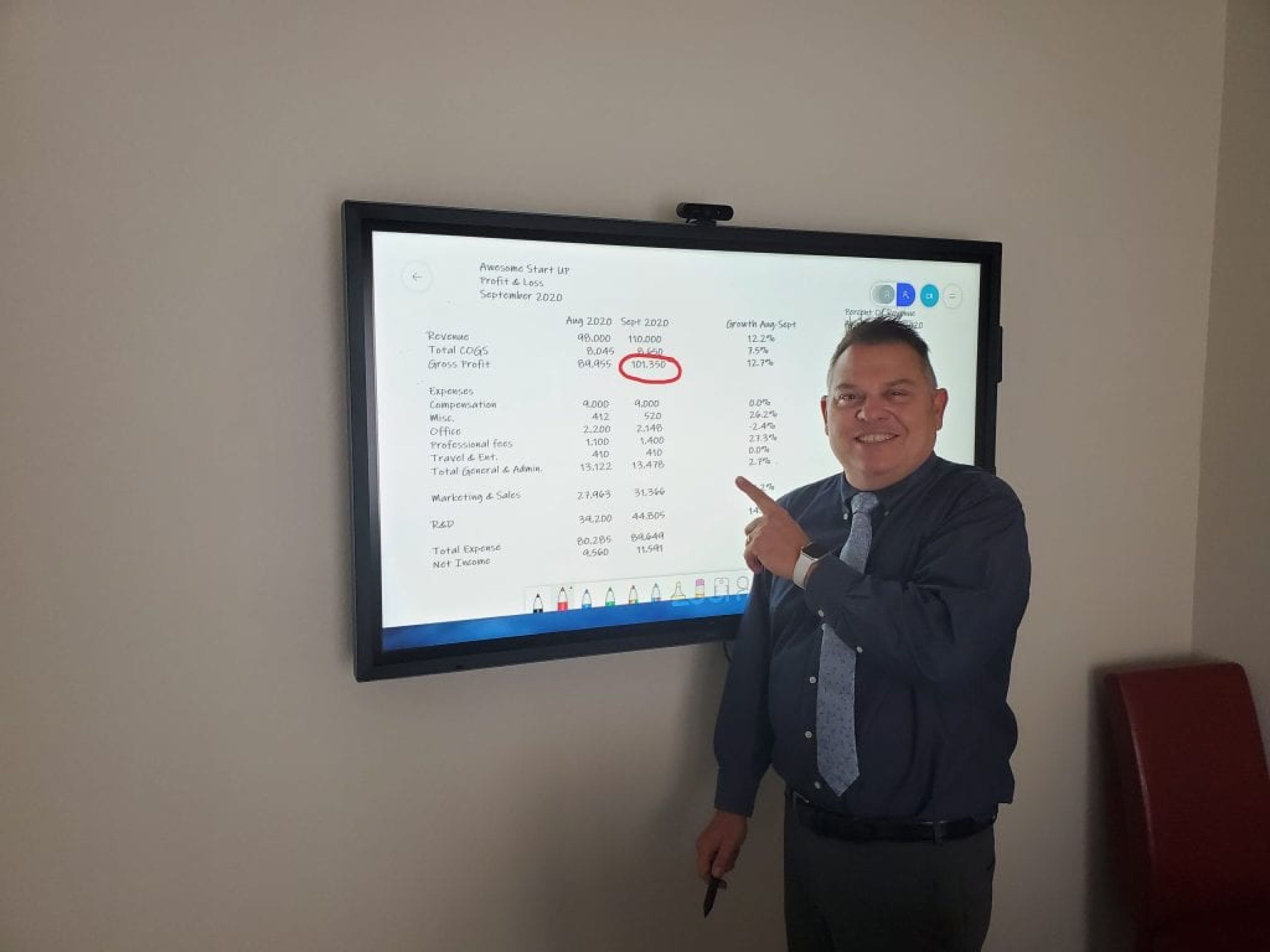

Use a CPA That Understands What Makes a Business Successful

John’s CFP experience of financial management has helped businesses jump to $100 million in sales. He knows the pitfalls and intricacies to guide you through creating a business that truly succeeds.

Not all CPAs have this kind of insight. Get in touch today and take your business to the next level.