Get the Most Out of Your CPA by Following This Simple Guide

Find a CPA That Specializes in Your Industry

If you’re in the market for a new accountant, it’s important to choose someone who can handle all your needs. While many CPAs are generalists, there are some who specialize in specific areas of accounting. For example, some are tax specialists while others are audit specialists. Some focus on small businesses while others handle only high-net-worth individuals.

If you have a lot of complex tax issues or other specialized needs, you want to make sure that person is available to you. If you’re just starting out and need help setting up your books, however, it may be more cost-effective to have a generalist take care of everything.

When choosing an accountant, ask about what areas they specialize in. Then make sure they’ll be available to take care of any specific projects you’ll need help with down the road.

Avoid These Mistakes When Working with a CPA

If you don’t have a CPA or if you’re thinking about switching accountants, here are some tips to help ensure that your relationship with your accountant is a fruitful one:

- Don’t pay for things you don’t need. CPAs can help you find deductions and other credits that might save you tax dollars, but the IRS also offers a list of free tax preparation options.

- If you need help, don’t be afraid to ask for it. Your CPA is there to serve your needs, so if you feel lost in the process of filing your taxes, don’t be afraid to ask for some guidance. Most CPAs are very familiar with the process and would be happy to help guide you through it.

- Ask questions ahead of time if necessary. If something doesn’t seem clear to you, don’t hesitate to ask questions before your appointment so that your time with your accountant is productive and efficient. Furthermore, asking questions can make it easier for both of you if there is something about your situation that makes filing complicated (for example if you own multiple businesses).

- Make sure your goals are clear. There’s a reason you’re vising a certified public accountant. Make that reason known from the start of your meeting so you can both make the most out of your visit.

3 Things You Shouldn’t Say to Your CPA

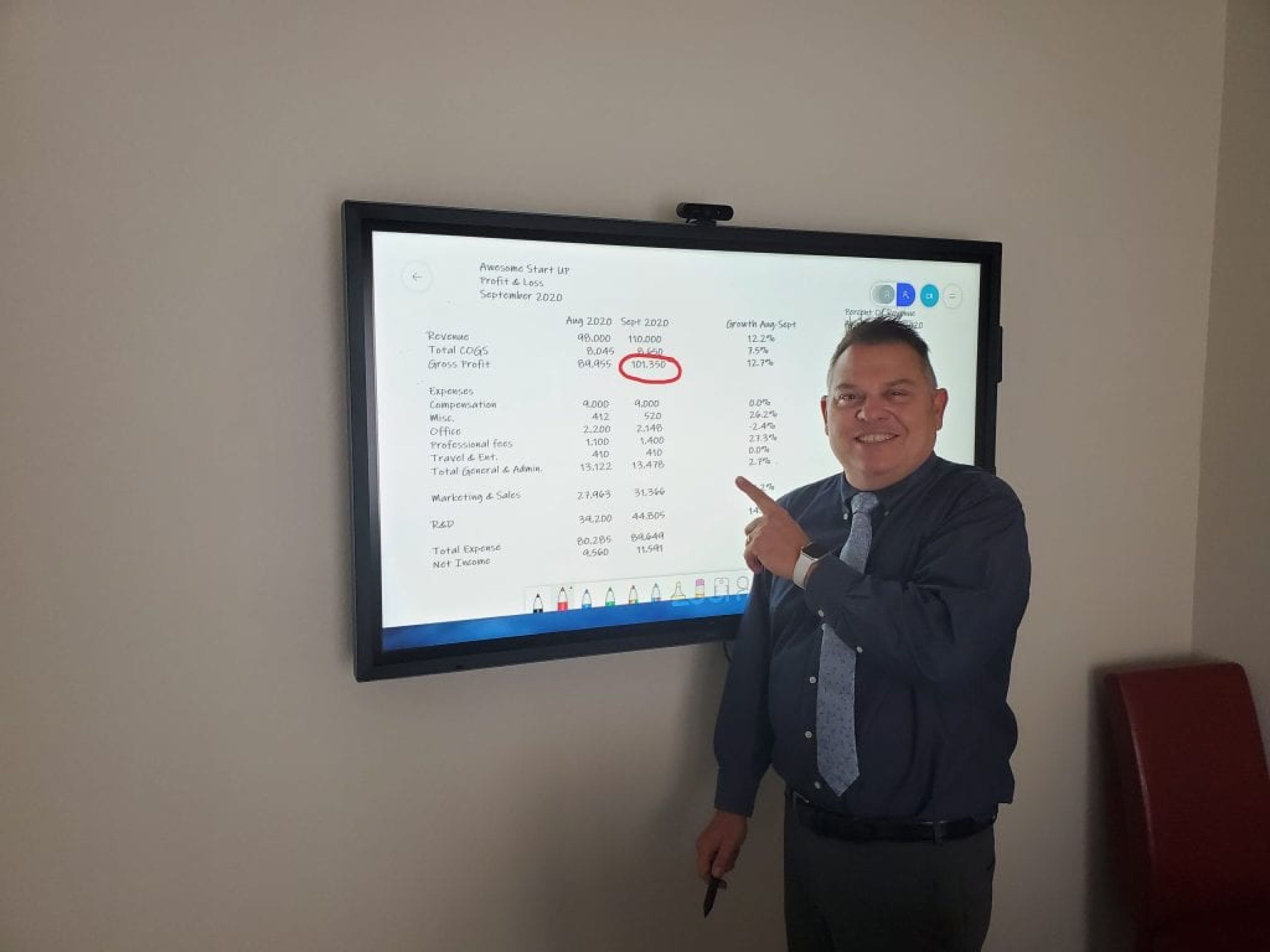

A good accountant will be able to help you minimize your taxes and keep better track of your financial situation, but only if he or she understands what’s going on with your business.

If you say: “You don’t know my industry.” Accountants and CPAs work with a wide variety of companies and individuals every day. Though they may not be familiar with your particular niche, they can probably draw on their experience with similar industries to help you out.

If you say: “I’m not paying for that.” Your accountant’s job is to ensure that you’re taking advantage of every possible deduction and credit possible. If you’re not using all the resources available to you, it’s the accountant’s fault — not yours — if something is overlooked.

If you say: “I don’t have time for this.” The worst thing a client can do is leave something important until the last minute. This means more work for your accountant and could potentially lead to mistakes.