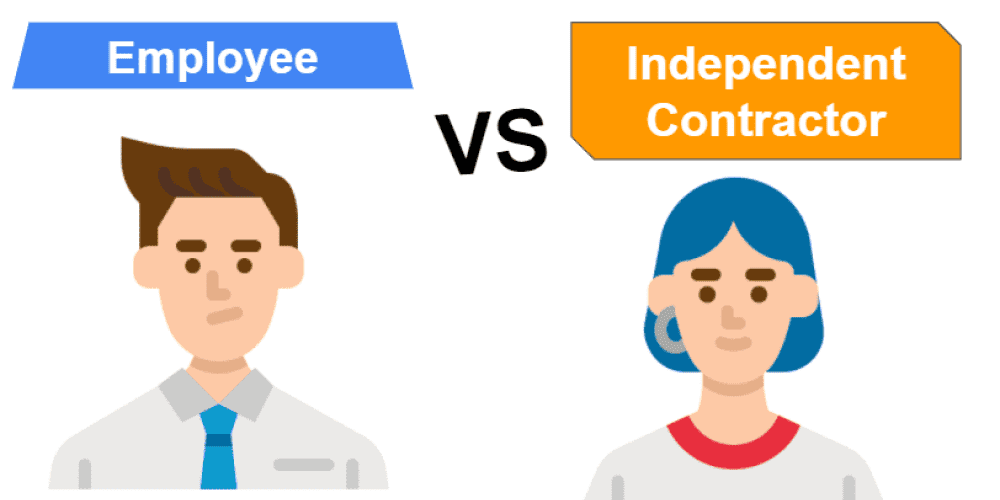

How Can I Successfully Hire Independent Contractors Instead of Employees?

Hiring a freelancer is a great way to fill a position, often without the overhead costs associated with a full-time employee. On the other hand, independent contractors have no benefits and come and go as they please. Sometimes, it turns out that hiring independent contractors is not the best option from a cost point of view. It may be better to hire employees instead. But how do you know?

In this post, we explore the factors you need to consider when deciding between hiring contractors or employees, how it can affect your business, and how to get away with hiring contractors instead.

The Difference Between Independent

Contractors and Employees

Your business may not be large enough to hire full-time employees, but that doesn’t mean you can avoid all of the hassles and expenses of having people on your payroll. You still need to determine which workers are employees and which are independent contractors and make sure you’re treating them correctly.

Independent contractors (ICs) are self-employed individuals who provide services to your company in exchange for compensation. ICs are responsible for their own taxes and insurance. In contrast, when you hire an employee, you assume responsibility for paying income taxes, Social Security taxes, unemployment taxes, and other employee benefit costs. You also have more legal responsibilities when it comes to maintaining a safe workplace, complying with wage and hour laws, and providing workers’ compensation coverage.

For many small businesses, the added responsibility of managing these employee-related issues makes it a better fit to hire independent contractors in lieu of full-time employees.

Tax Implications of Independent Contractors

Independent contractors can save employers money because they don’t get the same benefits as employees, such as health care and retirement plans. Contractors also offer employers more flexibility than traditional employees because they’re not subject to the same rules or restrictions.

If you hire an independent contractor, you may be able to write off some of his or her expenses on your taxes. However, there are factors to consider before claiming anyone as your business’s contractor. Be sure to follow these guidelines to avoid any problems with the IRS:

- The individual performs services that are outside your usual course of business

- The individual works for multiple businesses

- The individual is available to work for others

- The individual sets his or her own hours

- The work performed by the person is not part of your regular business activity

- The person has other clients or customers.

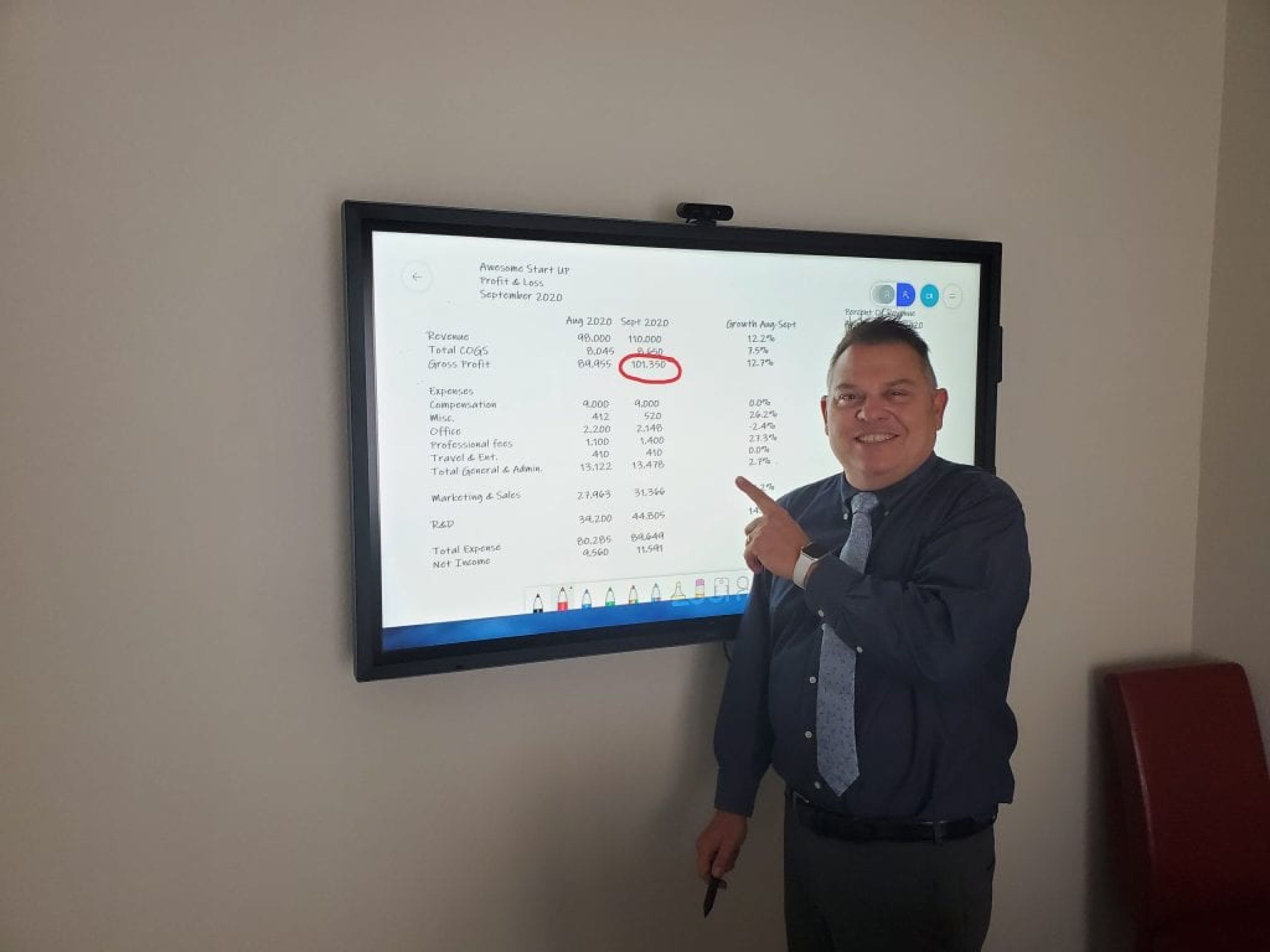

Understand What It Takes to Avoid Misclassification

Employees are subject to lots of laws employers don’t have to follow, including paying payroll taxes and over time, so it’s in your best interest to make sure you’re not misclassifying workers.

Employers who get caught misclassifying employees often end up owing money because they didn’t pay into Social Security or Medicare on behalf of their workers. Here are some ways you can avoid misclassification.

Don’t give them uniforms or company cars. If you’re providing any perks that are associated with employees, you’ll probably need to rethink how you’ve been classifying these individuals.

Make sure they get work from other companies. Your contractors aren’t employees if they have other clients. If the only work they get comes from you, that’s a tip-off that you might be their only source of income. They also can’t work for just one company for an extended period of time unless there’s a significant amount of downtime throughout the year.

Set specific hours and deadlines. You can’t expect an independent contractor to work whenever he wants, whenever he needs to meet a deadline. So if someone tells you that he works 24/7 because he’s self-employed, dig deeper before reporting him as an independent contractor on your tax return.

If you misclassify employees, it could result in issues when being audited by the IRS and state authorities, resulting in paying even more for payroll taxes and penalties.

Understanding the differences between employees and independent contractors can help you get away with hiring the latter and saving thousands when filing taxes. Contact us to make sure you’re filing correctly.