Follow These Steps to Create Your Own Business

Make a Business Plan

A business plan is a written document that describes a new business and its objectives, explains how the business will make money and lists information about the people who will own and operate it.

The business plan is a road map for starting a business. It helps you determine whether your idea for a new business is practical and profitable. A good business plan will also help you obtain financing to start the business.

A well-conceived plan will save you time, effort, and money in the long run. It will help you organize your thoughts, clarify your ideas about how you intend to start and run your new company so that there are no surprises and you can focus on getting started and operating your new business successfully.

Pick a Location

When you’re ready to select a business location, the first thing you need to do is pick the right state. There are differences in tax rules, minimum wage rules, insurance requirements, and other factors that should be taken into account before finalizing your decision.

The biggest difference between states is taxes. For small businesses, one of the best places to start is Wyoming. The state has no corporate income tax, no capital gains tax, and no franchise tax — all savings that can be passed along to customers or employees. If those aren’t as important factors for your business, consider Delaware as well as Florida and Nevada. These three states also have no corporate income tax and they’re all located in different regions of the country for maximum convenience.

No matter which state you choose, you’ll want to research the aforementioned rules and requirements to ensure they’re feasible for your new business.

Select a Business Structure

Next, you’ll want to select entity type or business structure for your business. Make sure you know the differences between each so you choose the one that best fits your business goals. The most common business structures include:

- Sole Proprietorship: The most basic business structure, you’re the sole owner and responsible for all business activities.

- Partnership: A group of two or more people who own and are liable for the debts of the company

- Limited Liability Company (LLC): An LLC gives you limited liability protection while allowing you to set up an entity with separate personalities for your personal and business finances if desired.

- Corporation: A corporation has more formalities than an LLC, but it also provides greater liability protection.

Choose a Business Name and Register Your Business

The name you choose for your business will be an integral part of its identity. It’s important that it’s short, memorable, and relevant to your business. The most important part of choosing a name is making sure it’s not already being used by another entity.

Once selected, you want to register your business. Check the requirements. Every state has slightly different registration procedures, so be sure that you understand all the steps necessary for your state. Many small business owners find that they are better off registering as an LLC or sole proprietorship rather than doing business as a general partnership.

Because of the many variations in state laws, it’s best to check with local authorities for specific details.

Get an EIN and Tax IDs

An Employer Identification Number (EIN) is a tax ID number that any business with employees in the United States needs. An EIN is similar to a Social Security number in that it’s a unique identifier, but an EIN is used specifically for business purposes.

Here’s what you need to do to get your tax ID numbers:

- Get your state tax ID number. This is required by all states except for Alabama, Louisiana, New Mexico, and South Dakota. To get this number, fill out the appropriate forms with your state government or revenue agency.

- Get your federal tax ID number. If you are not operating as an individual sole proprietorship, you will also need a federal tax number. This can be done by filling out Form SS-4 with the IRS, available here . If you are working as an individual sole proprietorship, you don’t need to get an EIN or separate tax ID of any kind, so long as no one else is being paid for services they provide you (other than spouses or family members).

- Once determined that you need an EIN, it can be obtained on the IRS’ website for free. Alternatively, you can opt to receive it through the mail for $5.

For assistance with any of your business endeavors, call us. We’re experts when it comes to taxation and bookkeeping.

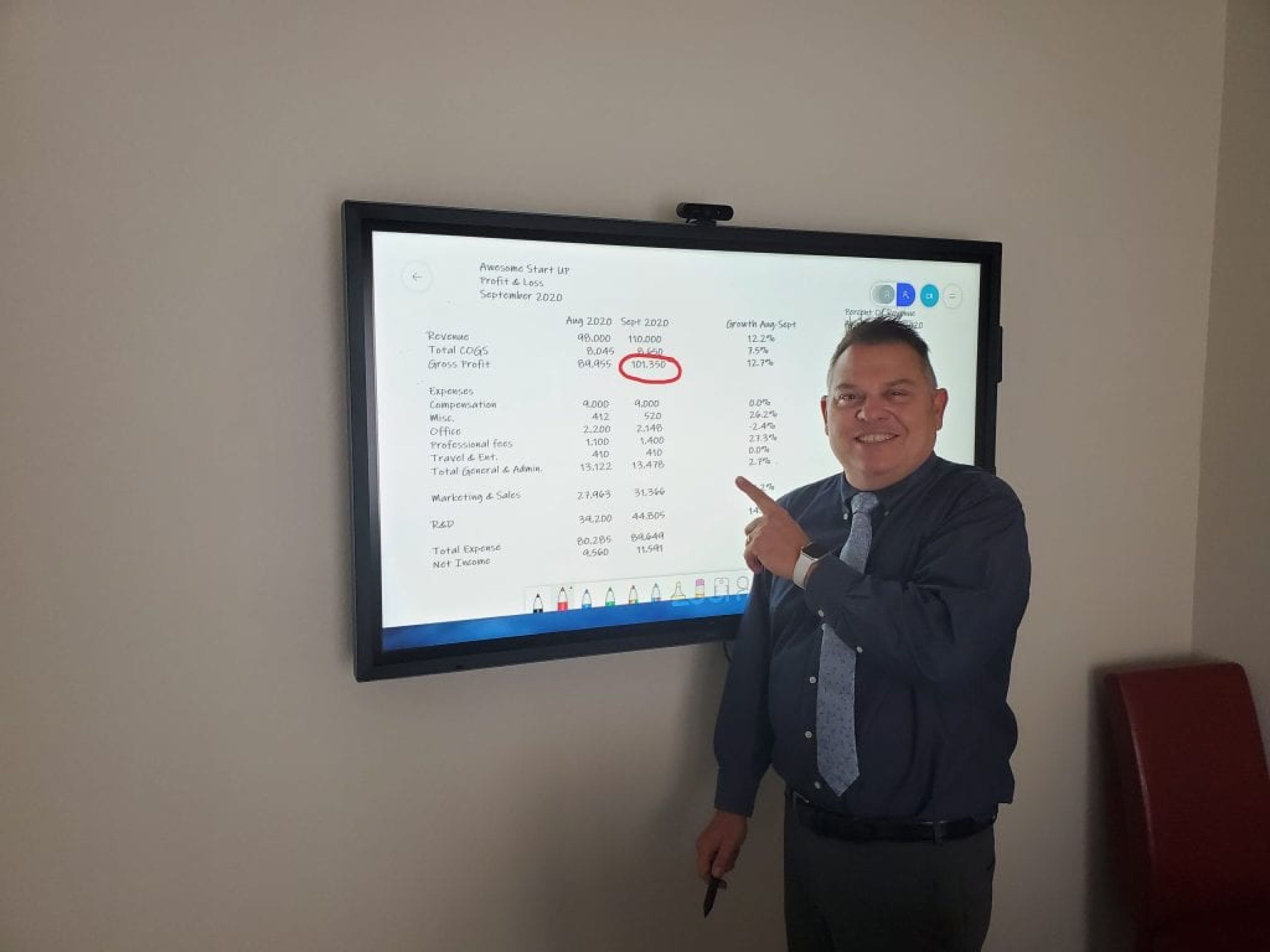

Use a Well-Connected CPA to Create Your Business without the Hassle

John is a well-connected CPA who uses his relationships with lawyers, bankers, insurance agencies, and CPAs to let your business hit the ground sprinting. Don’t pass this opportunity. Get in touch now and see what John can do for you.